In recent years, blockchain technology has emerged as one of the most transformative innovations across various industries, particularly in the realm of financial transactions. Initially gaining widespread attention as the underlying technology behind cryptocurrencies like Bitcoin and Ethereum, blockchain is now being recognized for its potential to revolutionize a wide range of sectors, from supply chain management and healthcare to identity verification and voting systems.

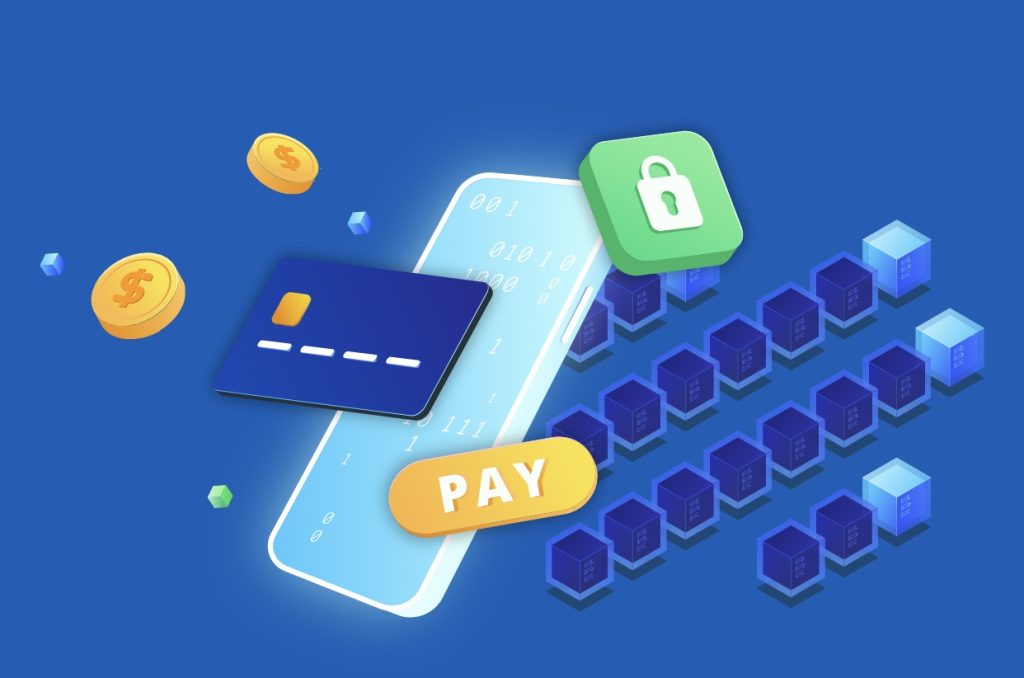

A key area where blockchain has had a profound impact is in the payments industry. As digital transactions continue to increase, so does the need for enhanced security, transparency, and efficiency. Blockchain technology addresses these challenges by providing a decentralized, immutable ledger system that ensures secure, transparent, and tamper-proof transactions.

In this article, we will explore the development of blockchain technology, its impact on the security and transparency of payment systems, and how it is reshaping the way we send and receive money. We will examine the key features that make blockchain a game-changer for financial services, the advantages it offers over traditional payment systems, and the challenges it faces in achieving widespread adoption. Finally, we will look at the future of blockchain in payments and the potential implications for businesses, consumers, and regulators.

1. Understanding Blockchain Technology

1.1 What is Blockchain?

At its core, blockchain is a distributed ledger technology that enables the secure, transparent, and decentralized recording of transactions. A blockchain consists of a series of blocks, each containing a list of transactions. These blocks are linked together in a chain, hence the name “blockchain.” Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data.

Unlike traditional databases, which are usually stored on centralized servers, a blockchain is decentralized and distributed across a network of nodes (computers). This means that no single entity has control over the entire network, making it resistant to tampering and fraud. The decentralized nature of blockchain also eliminates the need for intermediaries, such as banks or payment processors, in transactions.

1.1.1 How Blockchain Works

Blockchain operates through a consensus mechanism, where participants in the network agree on the validity of transactions. For example, in the Bitcoin network, transactions are validated through a process called Proof of Work (PoW), where miners compete to solve complex mathematical puzzles. Once a miner solves the puzzle, the transaction is added to the blockchain, and the miner is rewarded with Bitcoin. Other consensus mechanisms, such as Proof of Stake (PoS) used by Ethereum, also ensure that all participants in the network agree on the state of the ledger.

The key features of blockchain technology that make it unique are:

- Decentralization: There is no central authority overseeing the network, making it more resilient to fraud, hacking, or government intervention.

- Immutability: Once a transaction is added to the blockchain, it cannot be altered or deleted, ensuring the integrity of the data.

- Transparency: All transactions on the blockchain are publicly recorded and can be viewed by anyone, promoting accountability and reducing the risk of fraud.

- Security: Transactions are secured using cryptographic algorithms, making it nearly impossible to tamper with or forge transaction records.

1.2 Blockchain in Payment Systems

The adoption of blockchain in payment systems offers several benefits over traditional payment methods. In conventional financial systems, transactions are often processed through intermediaries, such as banks or payment processors. These intermediaries add layers of complexity, increase transaction costs, and slow down the payment process. Blockchain removes the need for these intermediaries by enabling direct peer-to-peer (P2P) transactions, resulting in faster, cheaper, and more secure payments.

For example, in cross-border payments, traditional banking systems can take several days to process transactions and often involve high fees due to currency conversions and intermediary banks. Blockchain-based payment systems, on the other hand, can settle transactions in minutes with lower fees, making them more efficient for international remittances and trade.

1.2.1 Key Benefits of Blockchain Payments

- Faster Transactions: Blockchain transactions can be processed almost instantly, even across borders. This is particularly beneficial for businesses and consumers who need to send money quickly, without waiting for several days for the transaction to clear.

- Lower Costs: By eliminating intermediaries, blockchain reduces the fees associated with traditional payment systems. This is especially important for cross-border payments, where banks and other financial institutions charge high transaction fees.

- Enhanced Security: Blockchain’s decentralized and cryptographic nature makes it highly secure. Each transaction is encrypted and linked to the previous one, making it nearly impossible to alter or reverse once it is recorded on the blockchain.

- Transparency and Accountability: Blockchain’s transparent nature allows participants to view the transaction history in real time, which reduces the risk of fraud and enhances accountability.

- Financial Inclusion: Blockchain technology offers an opportunity for financial inclusion, especially in regions with limited access to traditional banking services. Anyone with an internet connection can participate in blockchain-based payment systems, enabling them to send and receive money globally.

2. How Blockchain Enhances Payment Security

2.1 Cryptography and Data Security

One of the main reasons why blockchain technology is considered a secure method of payment is its use of advanced cryptographic techniques. Cryptography ensures that transactions are not only private but also protected from tampering or unauthorized access.

Each transaction on a blockchain is encrypted using a cryptographic algorithm known as hashing. When a user initiates a transaction, the data is hashed into a unique alphanumeric string. This hash is then added to the blockchain as part of a new block, where it is permanently recorded and cannot be altered.

The cryptographic techniques used in blockchain make it virtually impossible for hackers to manipulate transaction data. Even if a hacker were able to gain access to a block, they would need to alter the data in all subsequent blocks in the chain, which would require an enormous amount of computing power. This level of security makes blockchain highly resistant to fraud and cyberattacks.

2.1.1 Public and Private Keys

Another essential component of blockchain security is the use of public and private keys. In a blockchain-based payment system, users are assigned a public key, which is used to receive payments, and a private key, which is used to sign transactions and authorize payments.

The private key is kept confidential, while the public key is shared with others so they can send funds to the user. Since transactions are signed with the private key, it ensures that only the owner of the private key can authorize a transaction, adding an additional layer of security.

2.2 Fraud Prevention and Risk Reduction

Blockchain’s decentralized structure significantly reduces the risk of fraud and hacking. In traditional payment systems, centralized databases are often the target of cyberattacks, as compromising a single point of failure can give hackers access to sensitive financial data. Blockchain, however, operates on a distributed network of nodes, meaning that there is no single point of failure.

Each participant in the blockchain network holds a copy of the entire ledger, and all new transactions must be verified by the network before being added to the blockchain. This decentralized consensus mechanism ensures that all participants agree on the validity of a transaction, making it highly resistant to fraud.

Moreover, once a transaction is recorded on the blockchain, it becomes immutable. This means that the transaction cannot be altered or reversed, preventing fraudsters from altering the transaction history or “double-spending” funds.

2.2.1 Smart Contracts and Automated Security

Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, further enhance the security of blockchain-based payments. Smart contracts automatically execute predefined actions when certain conditions are met, without the need for intermediaries or human intervention.

For example, in a supply chain payment system, a smart contract could automatically release payment to a supplier once the delivery of goods is verified. This automated process reduces the risk of errors or fraud and ensures that all parties fulfill their obligations.

3. How Blockchain Improves Payment Transparency

3.1 Immutable Ledger and Audit Trail

One of the key features of blockchain technology is its ability to provide a transparent, immutable record of all transactions. Unlike traditional financial systems, where transaction histories can be altered or hidden, blockchain offers a permanent and publicly accessible ledger.

Every transaction on the blockchain is recorded in a block, and once a block is added to the chain, it is nearly impossible to modify or delete. This provides an audit trail that can be traced back to the origin of the transaction, ensuring full transparency.

For businesses and consumers, this level of transparency is crucial in ensuring the integrity of transactions. For example, in a payment system for charitable donations, blockchain could be used to track every donation, ensuring that the funds are used appropriately and that no money is misappropriated.

3.1.1 Reduced Risk of Fraud and Corruption

The transparency provided by blockchain technology significantly reduces the risk of fraud and corruption. Since every transaction is publicly recorded and can be verified by anyone in the network, it is nearly impossible to hide fraudulent activities.

For example, in the case of financial institutions or governments, blockchain-based payment systems could be used to track the flow of funds, ensuring that money is not siphoned off for illicit purposes. This level of transparency fosters trust among participants and reduces the potential for financial misconduct.

3.2 Real-Time Monitoring and Accountability

Blockchain’s transparent nature also allows for real-time monitoring of transactions. All participants in the network have access to the latest transaction data, enabling them to track payments as they occur. This feature is especially important for businesses that need to monitor cash flow and for regulators who need to ensure that transactions comply with legal and regulatory standards.

In industries like banking, insurance, and healthcare, blockchain can provide real-time data on payments and claims, helping organizations identify discrepancies or issues before they become significant problems.

4. The Future of Blockchain in Payment Systems

4.1 Widespread Adoption of Blockchain Payments

As blockchain technology continues to mature, we can expect to see its widespread adoption in the payments sector. Many financial institutions, payment providers, and governments are already experimenting with blockchain-based payment solutions. Central Bank Digital Currencies (CBDCs), which are digital versions of national currencies, are one example of how blockchain is being used to modernize the financial system.

The increasing demand for faster, cheaper, and more secure payment methods is likely to drive the continued growth of blockchain in the payments industry. As more consumers and businesses recognize the benefits of blockchain-based payments, we can expect the technology to become a mainstream solution for financial transactions.

4.1.1 Integration with Traditional Financial Systems

For blockchain to achieve widespread adoption, it will need to integrate seamlessly with existing financial infrastructure. Many banks and payment processors are already exploring ways to incorporate blockchain into their systems to improve efficiency and reduce costs.

In the future, blockchain may coexist with traditional payment systems, offering consumers and businesses greater flexibility in choosing their preferred payment methods. This hybrid approach could offer the benefits of both centralized and decentralized systems, depending on the use case.

4.2 Overcoming Challenges and Obstacles

Despite its many advantages, blockchain still faces several challenges that could hinder its widespread adoption in payment systems. These challenges include regulatory uncertainty, scalability issues, and the need for widespread education and awareness.

However, as blockchain technology continues to evolve, these challenges are likely to be addressed. With the support of regulators, industry stakeholders, and developers, blockchain has the potential to become the foundation of the next-generation payment systems.

Conclusion

Blockchain technology has revolutionized the payments industry by enhancing security, transparency, and efficiency. Through its decentralized, immutable ledger system, blockchain ensures that payments are secure, fraud-resistant, and transparent. The integration of blockchain in payment systems has already begun to reshape the financial landscape, and its adoption is expected to grow in the coming years.

As blockchain continues to evolve, it holds the potential to further disrupt traditional payment systems, offering consumers and businesses faster, cheaper, and more secure ways to transact. While challenges remain, the benefits of blockchain in payment systems are undeniable, and its future looks bright as it continues to revolutionize the way we conduct financial transactions.